Contents:

Tax laws and regulations can be complex, and calculating tax shields can be challenging. Taxpayers must understand the rules and regulations that apply to each type of tax shield and ensure that they are accurately calculating the deduction or credit. Taxpayers can deduct state and local income, sales, and property taxes from their taxable income. These are multiple sorts of tax-deductible expenditures incurred throughout the year. Who have paid more in medical expenses than covered by the standard deduction can choose to itemize to gain a huge tax shield. Tax shields lower tax bills, one of the major reasons why taxpayers, whether individuals or corporations, spend a considerable amount of time determining which deduction and credits they qualify for each year.

Tax shields lower the amount of taxes an individual or business taxpayer owes. As a preface for our modeling exercise, we’ll be calculating the cost of debt in Excel using two distinct approaches, but with identical model assumptions. With that said, the cost of debt must reflect the “current” cost of borrowing, which is a function of the company’s credit profile right now (e.g. credit ratios, scores from credit agencies). Higher Cost of Debt → If the credit health of the borrower declined since the initial date of financing, the cost of debt and risk of lending to this particular borrower increases.

Tax Shield Calculator

The present value of the interest tax shield is therefore equal to the formula in Eq. Tax Shield provides important tax breaks which help individuals and businesses to reduce their taxable income leading to lower tax liability. Every country’s tax system provides a list of instruments and income slabs along with threshold limits of tax exemption items that can be availed by the business and individuals to obtain a T.S. Also, a Tax shield is an important component in investment decisions both for businesses and Investors.

When you run a business, the equipment needed – such as computers and printers – wears out over time. Likewise, if you have investment properties or other assets that depreciate, you can quantify this loss of value in a tax deduction. For instance, IRS standards dictate that a commercial property generating revenue depreciates over 39 years.

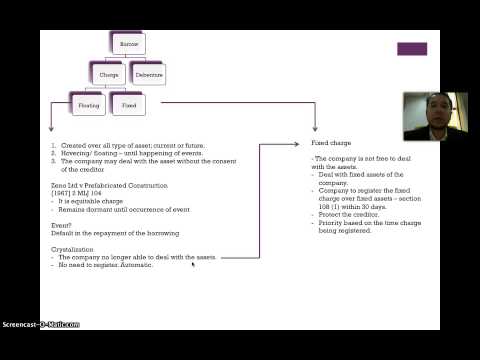

Cost of capital is measured by weighted average cost of capital before tax according to Eq. T.S implies a reduction in tax liability on account of investment in tax-deductible instruments as well as interest tax shields from interest expenses paid by the business. Tax shield enables enterprises to use leverage in their capital structure as interest paid on debt borrowing is tax-deductible. Tax shield works as part of individual tax planning and for business as part of corporate business strategy.

The issue of tax shields is an increasingly important object of interest for both business managers and academics. Worldwide in recent years, the volume of leveraged buyouts and management buyouts has increased. This implies that taxpayers who have spent more for medical expenditures than the minimum covered deduction will be able to itemize their deductions to claim more tax savings. Implementing an effective tax shield strategy can help increase the total value of a business since it lowers tax liability.

How do Bonds Function as a Tax Shield?

It is crucial to consider the impact of any short-term variations in depreciation and capital cost allowance. Interest expenses on certain debts can be tax-deductible, which can make the entire process of debt funding much easier and cheaper for a business. This works in the opposite way to dividend payments, which are not tax-deductible. A tax shield is a legal strategy to help reduce the amount of taxes owed on taxable income.

It is the only way by which we can save cash outflows and appreciate the value of a firm. Tax shield in various other forms involves the type of expenditure that is deducted straight away from taxable income. A tax credit is a direct reduction in the amount of tax owed, rather than a reduction in taxable income. Tax credits are offered for a variety of purposes, such as investments in certain industries, research and development, and energy efficiency. Assume that the corporate tax is paid one year in arrear of the periods to which it relates, and the first year’s depreciation allowance would be claimed against the profits of year 1. Get instant access to video lessons taught by experienced investment bankers.

What is Cost of Debt?

Therefore, debt and tax shield are equally risky; both components should be discounted at the same discount factor . The newly created value results from tax deductibility of interest and represents the value of tax shield. More than 50 years of research on tax shield has brought a number of theories to quantify them. The main area of research is the interest tax shield, which has a direct influence on the company’s decision about the capital structure, acceptance or non-acceptance of investment projects.

- And tangible assets like buildings are eligible for the deduction.

- Only costs paid out of pocket for medical care during the current tax year are deductible.

- Hence, we can see from the above example due to the depreciation tax shield the operating inflow is to be better managed.

- If the tax rate would not change, then the marginal benefit resulting from the debt is equal to the tax rate, and the value of company changes in proportion to the value of debt.

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

Tax Shield: Definition, Formula for Calculation, and Example

Booth et al. investigated capital structure in developing countries. They found that capital structure in developed and developing countries are affected by same firm-specific factors . Nevertheless, they found out that there are differences such as GDP growth, capital market development and inflation rates.

Adjusted Present Value (APV): Overview, Formula, and Example – Investopedia

Adjusted Present Value (APV): Overview, Formula, and Example.

Posted: Sun, 26 Mar 2017 05:06:40 GMT [source]

Tax shields can be an important factor in a company’s financial planning and decision-making. By reducing their tax liability, companies can increase their after-tax earnings and improve their overall financial performance. The Interest Tax Shield refers to the tax savings resulting from the tax-deductibility of the interest expense on debt borrowings. The payment of interest expense reduces the taxable income and the amount of taxes due – a demonstrated benefit of having debt and interest expense.

Tax Shield

A depreciation tax shield is one of the measures through which tax is to be reduced. It is inversely related with the tax payments higher the depreciation tax shield lower will be the depreciation. Depreciation is the non-cash expense hence with the proper planning the net operating cash flows can be increased and better management of funds are to be done. In capital budgeting also it is one of the useful tools to decide whether to purchase the asset or to lease the asset. Tax payments can be better managed with the depreciation tax shield.

In addition, governments often create tax shields to encourage certain behavior or investment in certain industries or programs. Cash FlowCash Flow is the amount of cash or cash equivalent generated & consumed by a Company over a given period. It proves to be a prerequisite for analyzing the business’s strength, profitability, & scope for betterment. Tax AdvantageTax Advantage are the types of investments or saving plans that benefit tax exemption, deferred tax, and other tax benefits. Deduction As Mortgage InterestMortgage interest deduction refers to the decrease in taxable income allowed to the homeowners for their interest on a home loan or any borrowings for house repair or improvement. On the other hand, Company B’s taxable income becomes $31m after deducting the $4m in interest expense.

Taxes are levied on tangible property, including real estate and business dealings like stock sales or house purchases. Income, corporate, capital gains, property, inheritance, and sales taxes are among the several types. This, in turn, makes debt funding much cheaper since interest expenses on debt are tax-deductible. The strategy by which we minimize tax liability and increases the value of a business.

So, you can divide the value of your building by 39 to get your tax shield formula deduction amount. Unfortunately, depreciation for other assets is not as straightforward, so it’s best to work with a tax professional to calculate it. Giving to charitable organizations can shield you from a hefty sum of income taxes. Typically, you can deduct cash donations equal to 60% of your AGI and asset donations equal to 30% of your AGI. In addition, capital gains taxes receive a 20% deduction for the donated asset.

If you don’t report every element of your income—including bonuses paid by your employer and tips—then you are guilty of tax evasion. If you deliberately claim specific tax credits that you’re not eligible for, then you are committing tax fraud. The difference in EBIT amounts to $2 million, entirely attributable to the depreciation expense.

Drugmaker AbbVie shielded profits from U.S. taxes, Senate report says – The Washington Post

Drugmaker AbbVie shielded profits from U.S. taxes, Senate report says.

Posted: Thu, 07 Jul 2022 07:00:00 GMT [source]

Tax savings do not arise because the company does not pay any tax. The value of unlevered and levered company according to Fernandez . Inselbag and Kaufold recommend using the Myers model if the value of debt is constant; in the case of fixed leverage, the Miles and Ezzell model is suitable.

It can also be defined as the percentage of a company’s long-term investment in an asset that the firm claims as a tax-deductible expense throughout the asset’s useful life. Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. Claiming tax shields can increase the risk of audit from the tax authorities.

These include the development of the capital market, inflation or the size of businesses . The weak development of the capital market, especially bond market, means that the company cannot take advantage of the possibility of issuing a bond. Therefore, it is not possible to determine the market value of debt, and market value-based theories of the tax shield cannot be applied. Unlike Myers’ adjusted present value, decomposition method discounts all cash flows at the same discount rate . One of the advantages of the model is that it is not necessary to estimate weighted average cost of capital. Chapter focuses on the identification and analysis of selected methods for measuring the value of tax shield with an emphasis on the interest tax shield.

Tax shields can provide financial flexibility by allowing taxpayers to take advantage of deductions and credits to reduce their tax liability. This can free up more cash flow for other uses, such as paying down debt or investing in new opportunities. Tax shields allow taxpayers to reduce their taxable income by deducting certain expenses or costs.

A Tax Shield is an allowable deduction from taxable incomethat results in a reduction of taxes owed. Tax shields differ between countries and are based on what deductions are eligible versus ineligible. The value of these shields depends on the effective tax rate for the corporation or individual . The first of the analyzed theories is the model of Modigliani and Miller , which is outlined in the previous section. According to the assumptions of the model, the company can borrow and lend money on perfect capital markets at risk-free rate and market value of debt is constant.

It is debited to profit and loss account as expenses which reduces the profit and ultimately the tax is reduced. A depreciation tax shield is the amount of tax saved due to depreciation expense which is calculated as depreciation debited as expenses multiplied by the applicable tax rate to the entity. The depreciation is allowable to the business entity for the assets used for business and on personal assets no depreciation is allowed as expenses. Hence depreciation tax shield is only available to the business entities. For example, if the profit of the organization is $ 500,000 before depreciation and depreciation is $ 200,000 and the applicable tax rate is 20%. So, the depreciation tax shield will be $ 200,000 multiplied by 20% which is equal to $ 40,000.

INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more. Next, the tax rate that applies to the company is determined, depending on the jurisdiction. The ability to use a home mortgage as a tax shield is a major benefit for many middle-class people whose homes are major components of their net worth. It also provides incentives to those interested in purchasing a home by providing a specific tax benefit to the borrower.